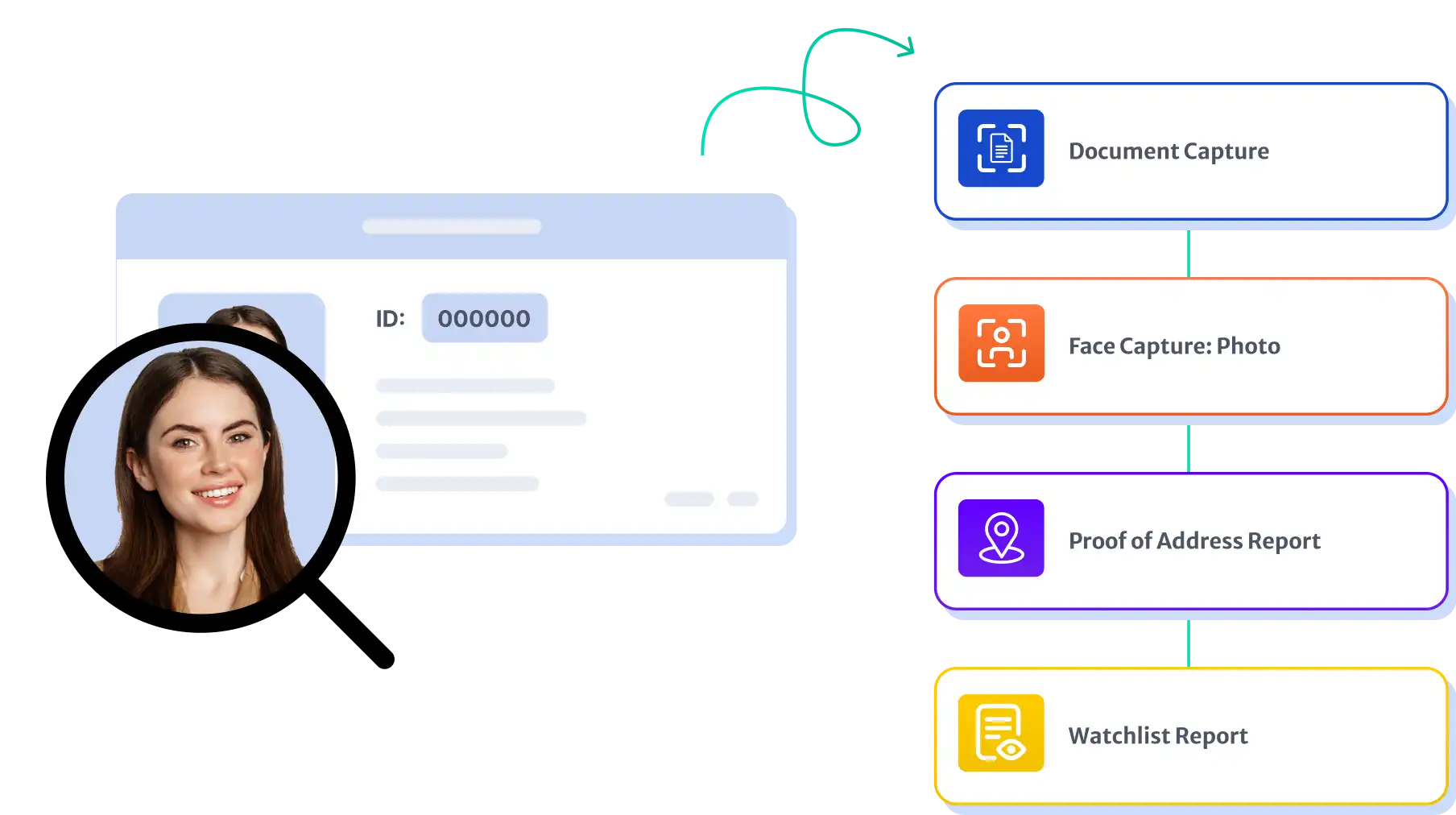

Automated continuous screening and monitoring solution that leverages ML and data analytics to ensure exhaustive document forensics, CDD, and AML checks while providing seamless customer experiences

Book A Demo

Lack of systems that leverage machine learning and AI result in inconsistent document analysis and failure in identifying fraudulent documents.

This is a critical challenge for financial institutions as most solutions available in the market fail to accurately detect fraud patterns in transactions and behaviour.

Companies face a significant challenge in identifying unusual transaction patterns and screening against watchlists of high-risk individuals and entities.

Most organisations struggle to conduct effective customer due diligence process while dealing with high risk customers or industries which results in fraud.